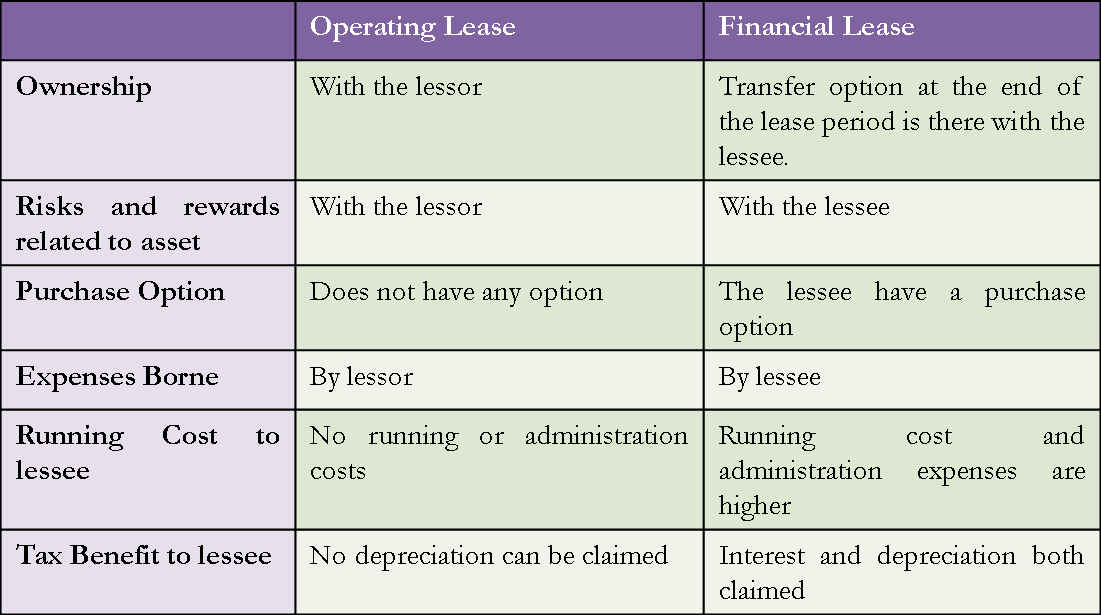

Operating Lease Vs Finance Lease Example ~ Indeed lately has been sought by users around us, maybe one of you personally. Individuals now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of the article I will discuss about Operating Lease Vs Finance Lease Example. Operating lease on the other hand can be canceled even during the primary period of a contract. A capital lease or finance lease is treated like an asset on a company s balance sheet while an operating lease is an expense that remains off the balance sheet. Operating vs finance leases under ifrs 16. Think of a capital lease as more like owning a piece of property and think of an operating lease as more like renting a property. In order to differentiate between the two one must consider how fully the risks and rewards associated with ownership of the asset have been transferred to the lessee from the lessor. How do you determine if the lease is a finance lease or an operating lease. Under ifrs 16 however there is only one classification finance leases which are classified on the financial statements as long term debt. Operating vs finance leases what s the difference. Leases now follow a single. Finance lease is commonly used for financing vehicles particularly hard working commercial vehicles where the company wants the benefits of leasing but does not want the responsibility of returning the vehicle to the lessor in a good condition. One of the provisions of this new standard is that all leases must be recognized on a company s balance sheet. Difference between financial lease vs operating lease. For example the main difference between a finance lease and an operating lease is financial lease can t be canceled during the initial period of the contract. Capital lease vs operating lease. In an operating lease no running or administration costs are borne by the lessee including registration repairs etc since this lease gives only the right to use the asset. In a financial lease running costs and administration expenses are higher and are born by the lessee. If the lease meets any of the following five criteria then it is a finance lease. Determining finance lease vs. In a finance lease agreement ownership of the property is transferred to the lessee at the end of the lease term. But in operating lease agreement the ownership of the property is retained during and after the lease term by the lessor.

A finance lease example. In a financial lease running costs and administration expenses are higher and are born by the lessee. How do you determine if the lease is a finance lease or an operating lease. If you re looking for Operating Lease Vs Finance Lease Example you've arrived at the perfect place. We ve got 12 images about operating lease vs finance lease example including images, pictures, photos, backgrounds, and much more. In such web page, we also provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

In a finance lease agreement ownership of the property is transferred to the lessee at the end of the lease term.

Finance lease identification under asc 842. Operating vs finance leases what s the difference. In order to differentiate between the two one must consider how fully the risks and rewards associated with ownership of the asset have been transferred to the lessee from the lessor. How do you determine if the lease is a finance lease or an operating lease.